-

FREE Study Course – How to Start a Home Based Travel BusinessFREE Study Course – How to Start a Home Based Travel Business

-

Travel Agent BooksTravel Agent Books

-

Host AgenciesHost Agencies

-

Article LibraryArticle Library

-

ScamsScams

-

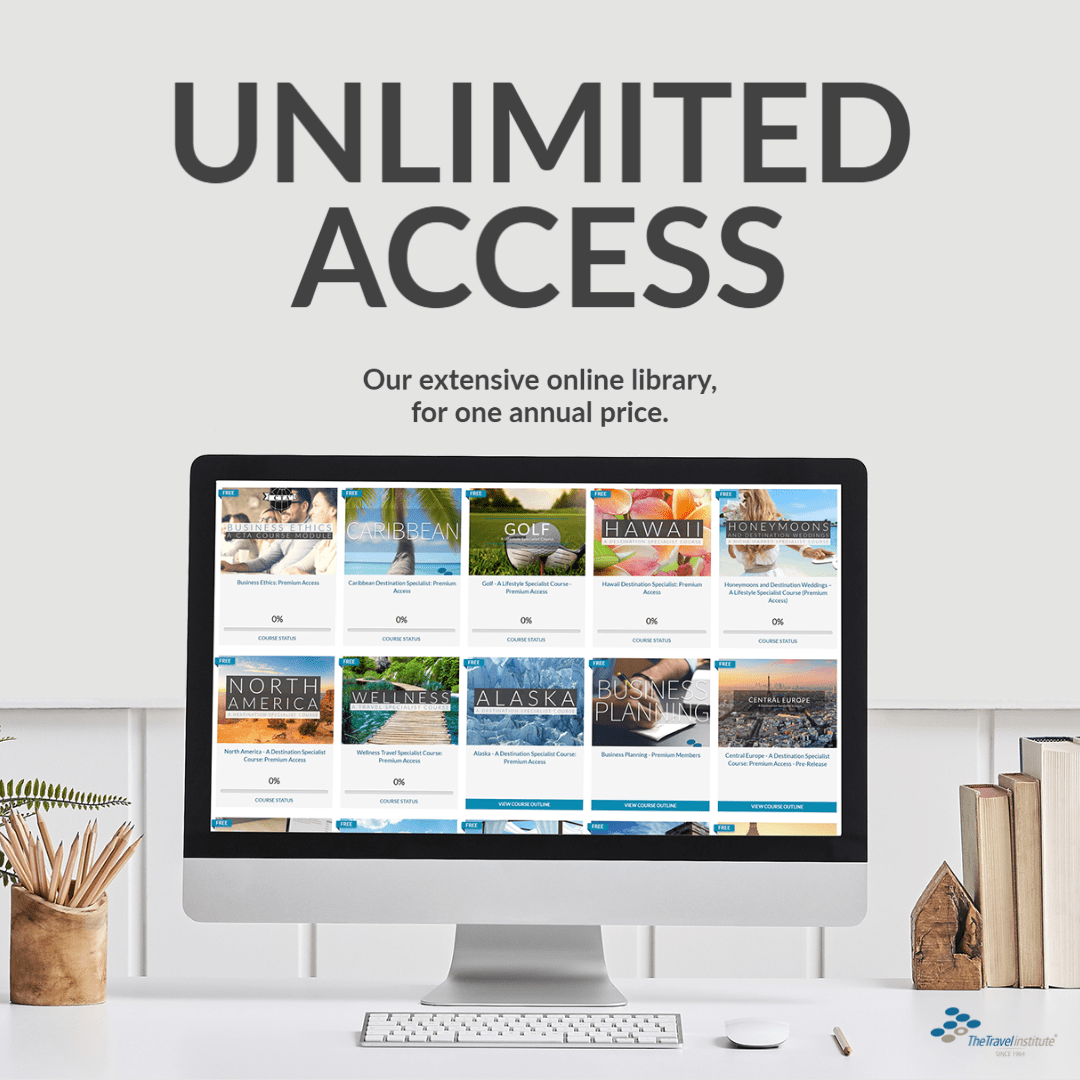

Education and TrainingEducation and Training

-

OpportunityOpportunity

TOP SELLING BOOKS

STAY UP TO DATE

KINDLY LOGIN OR REGISTER TO ACCESS THE CONTENT OF THE WEBSITE

Reasons to Register with HomeBasedTravelAgent.com

Instant Access to the Groups, Resource Library and Video Library!

Instant Connection with Fellow Home Based Travel Agents, just like you!

Discounted Pricing on over 10 Book Titles, focused ONLY on Home Based Travel Agents!

A True Home for the Home Based Travel Agent Community!

Loading…